Insight Session of Marketing Research Association Reviews Retail Audit

The more accurate data brands have about the market the more successful future they would illustrate for themselves. One way to get information about the market is the retail audit. The Marketing Research Association of Iran, in its most recent insight session, has examined different aspects of the retail audit. The presentation was made by Kamyar Emami, CEO of Emrooz Market Research Company (EMRC) and Alireza Iran-Manesh, Retail Client Service Manager of EMRC.

What Is Retail Audit?

Goods produced by manufacturers reach the consumers through different routes. In retail audit, that part of the merchandise delivered by the retailers to the consumers is evaluated. Of course, sometimes the goods are delivered to the end-users by the wholesalers who will never be considered in the retail audit evaluation, as they would distort the information data. Retail audit is an important tool that in businesses sales managers can use to gain access to extent of their sales and market share. On the other hand, retail audit data outlines the extent of the movement of the businesses and thereby brands can follow the movement trend of their competitors. The final retail audit data is accurate and can be cited on the basis of which the businesses can make decisions. Also, the retail audit shows the businesses the opportunities and market vacuum and tells them how to fill in the vacancy of the market.

History of Retail Audit

Retail audit was launched for the first time in 1930 by Arthur Charles Nielsen. In that year Nielsen carried out this research for pharmacies. In the 60s, this research made significant progress and was implemented every two months in Europe. In those years, information was provided to the consumers with the help of ruler and paper because of the lack of Excel software.

Data was scanned in the 1980s in the retail audit research. This year, major chain stores in Europe began to work. Scanning data would increase the accuracy of the data, but after submission the scanned data also varies with the internal business data.

It should be noted that concentration of the retail data between 1960 and 2016 in Europe decreased from 20,000 shops to 5600 stores because, over that period, large and chain stores in Europe started to work. In Iran, there are about 54,000 retail stores.

History of Retail Audit in Iran

In 2002, retail audit was implemented by MEMRB Company on a bi-monthly basis for food and non-food products. Following the closure of MEMRB Company in Iran in 2011, EMRC conducted the retail audit research. Of course, after a short period of time a company (former MEMRB) is offering retail audit services to the businesses in line with EMRC. At present, companies are implementing this research method for their specific customers. The EMRC started with monitoring 15 cities which has currently increased to 24 and is developing the retail audit as product at specific period of time. When we talk about the product, it means that EMRC does not conduct the retail audit for a single client rather it prepares and conducts the research on a regular basis. EMRC implements the retail audit in various sectors of the market, such as food, non-food, medicine, cigarettes, etc.

Advantages of Retail Audit

Retail audit can answer various questions raised by businesses. Questions like:

• What developments the market has been faced with?

• What share of the market have the brands allocated to themselves?

• Which part of the market has made growth?

• How the market share of a brand goes up and down?

• What goods are the consumers encouraged to buy at different times?

• To what shape and direction packaging is inclined to?

• How are the pricing changes and price fluctuations in the market?

• How are product changes in terms of size?

• Observance of position of products in different stores and what place such products have gained?

• How the products are distributed in retailers? Choosing the right place for distribution will significantly help more sales and earnings of higher share.

• Analyzing the moving trend of competitors in the market (method for getting market share, products present in the market, pricing practices, distribution methods)

• Balancing brand products by analyzing the moving trend of competitors in the market

• What do the customers see on the shelves in the retailers and where in the shelves the products are best seen?

• Avoiding share demanding of the brands of a business from each other (when a company runs two brands in one area, it should be careful that the two brands do not demand shares of each other).

About this question sometimes the research data fails to match with the company data and they say the product has good sales but has received no market share. In this case, two brands of a company due to similarities in the packaging and pricing have taken share from each other.

Businesses should have the correct arrangement of the retail audit data in order to get a better picture of their position and that of the movement of competitors in the market. In the meantime, sometimes the internal data of brands with less distribution do not fit the retail audit data. For these businesses, researchers would make changes in the main panel of research and would go to the places where distribution is underway. But they can also properly use other parts of the information to select the right place for distribution and so on. Distribution of the retailers in Iran is very complicated and this has caused challenges for collecting the data. The way data is used by brands is another challenge that market research companies should solve.

Who Has the Possibility to Use Retail Audit?

• Sales and marketing teams of the companies can easily use the retail audit data and make decision on their basis.

Such teams, based on the data outcome, can choose better shelves for product distribution and allocate more space to them. The vacant space of the market will also be identified through the data and the distribution system will be organized. The marketing team can also identify and calculate market share through the data. Accurate pricing is also possible based on the data.

• Decision makers in the companies can also use retail audit data in order to conduct market analysis, choose distribution team, codify strategies for entering into the market, etc.

• Managers who are in contact with the retailers and stores and are considered customers of such managers. Based on the data, managers can choose their customers and implement their considered promotions.

• Regional managers who through analyzing the research data can also analyze the sales and distribution of the product in their cities. The data shows them in which cities they have had better sales and in which cities they should change their approach.

Method to Set Up and Run Retail Audit

Below, the trend which should be applied for the implementation of the retail audit is discussed:

• To start with, the number of retailers and stores in the area under evaluation will be carefully measured and their number will be counted. This case is similarly applied to all industries.

• The specialized and research panel of retail audit will be regulated and chosen on the basis of the information obtained. At this stage, those who collect information will begin their activity based on a pre-designed plan. These groups of people should refer to the stores and retailers and collect information such as the size of the store, the number of fridges, the size of the storeroom, etc. through questionnaires. Based on this information, the research panel is set up. This panel can be applied to the entire community. Regarding the market conditions and changes, every two or three years a renewed census is conducted and the retail audit panel is reviewed. Of course, at each visit, the questioner records the changes. Keeping the panel is a matter of significant importance. At this stage, the questioner’s method of communication with the shopkeepers is important. Training the questioners is also important. The questioners should carefully check the shelves and record their conversation with the shopkeepers. They should be familiar with the terms and definitions. The questioners should be sensitive to the changes of the shopkeepers and should carefully review sales changes. In these definitions, shops that are called retailers would be precisely defined. The questionnaires would include products that have remained in the stores from the past and their barcodes as well as the new products and their new barcodes.

• Data collection based on research panel. The data collected in this section is either through questions from the retailers or through a scanner. The Iranian retailers often do their own sales mentally and do not use scanners. Usually the retailers are afraid of giving information about the way of selling, etc. The method of the activity of the questioner and the size of the panel will reduce the data collection error. At this stage, the research company will consult with its client and specify definitions on the basis of which data will be collected. Also, the data will be collected at different periods of time. These time periods depend on the type of the fast moving product and so on. The more time consumption for data collection is shortened, the more accurate information is obtained.

• Design and information process. At this stage, the data collected will be checked with the questioners and shopkeepers. In the information processing the data of different cases such as products, product segmentation, product packaging in the course of the collection, and so on will be reviewed. This information is different for each product. In the retail audit details of the products are reviewed carefully.

• Analyzing the data and presenting the report

Responsibilities of Research Companies before Customers

Customers expect research companies to present accurate information about the trend of the product movement in the market. Also, the customers expect the research companies to present to them an accurate data output along with reports. Research companies by creating a specialized team and launching research and field work, will control the high-quality information data with scrutiny and at the end teach the customers how to use the research output.

Challenges Facing the Customers after Receiving Information

Usually, the customers after receiving the information will react to the market share of their brand and do not consider it right. Companies can respond to this in two ways.

• Coverage analysis

By dividing the number the retail audit presents to the companies to the sales of the companies, a data will be obtained which, if close to 160, the research data is closer to reality. Such information will be reliable for companies.

Companies should consider the same period when the research has been conducted. The stability of the period greatly helps to make the data more real. Also, the data collection space is important. For example, if the real sales space is reviewed in the research, companies cannot include their online sales in the calculation.

• Coverage stability

Percentage changes that the retail audit shows from the sales of companies should be fixed and in a specified period of time. Fluctuations create suspicion in data. Percentage changes should not be 5% or 10% higher in each period.

By reviewing the brand movement trend of their own and that of their competitors, the retailers’ practices, reviewing their own promotional campaigns and those of their competitors, and distribution of products, the businesses will gain a better understanding of the retail audit. In such reviews, they will notice changes.

Contradiction of research data

• Time is very important in the analysis of the retail audit data. Sometimes companies have sold products, but until the time the product reaches the final consumer from the retailer it will take about two months. In such circumstances, the company has had selling but the retail audit does not show it. Researchers in this case state that the companies need to wait for some time so that effects of the sales will be shown in the data. Of course sometimes the retailers will buy the products from the companies but will store them and will not sell them to the consumer. In this case, the company has had selling but it is not shown in the data. In this case, it is possible that the data show some error. The more the brand is specified and its distribution is more accurate, better data will be obtained.

• The distribution method of the sales agents of the company: Sometimes the sales agents offer a lot of products to some retailers because of having good communication with them. It is possible that they have five major retailers but only one retailer is in the panel. In this case, the sales volume of the companies has not been considered carefully because the distribution of the companies is not balanced.

• Selecting a specific city and reviewing it will greatly help reduction of the controversy.

In total, the more the customers are placed next to the research companies, and at each stage they measure the data together and remove the contradictions, better information will be achieved.

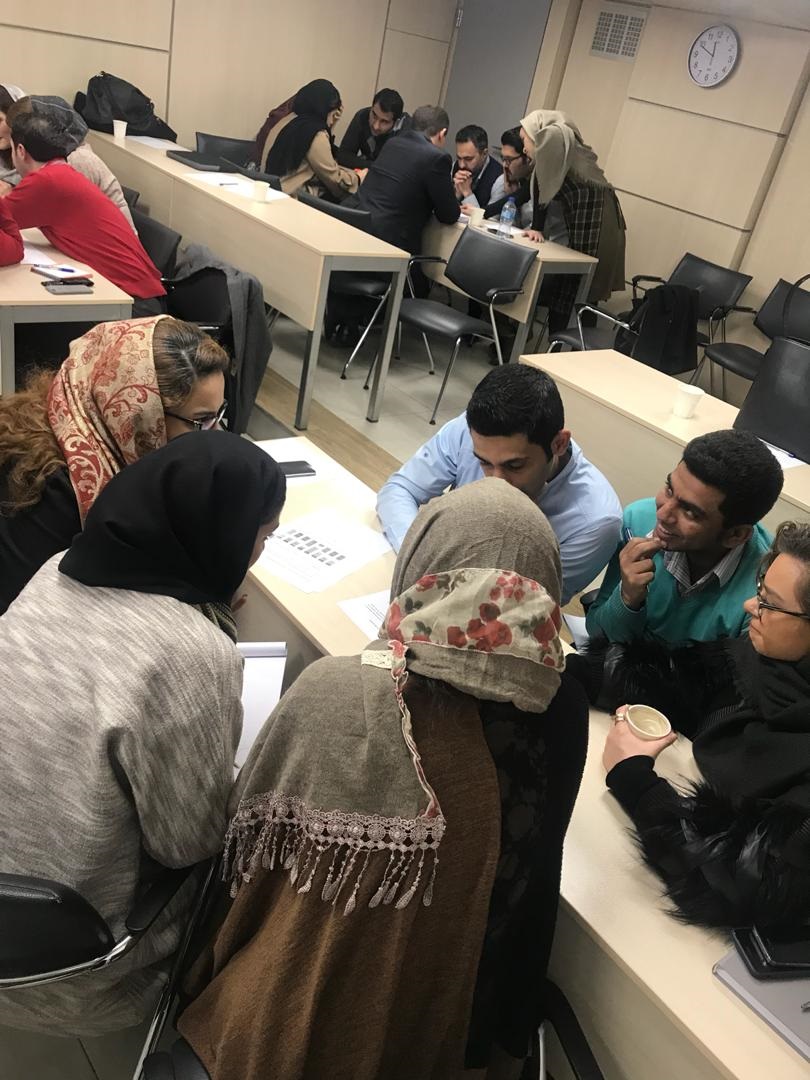

The insight review session of the retail audit was held by conducting a group work in which the participants analyzed samples of the prepared data and concluded by answering the questions of those who attended the gathering.